Organisations are changing faster than they ever have in 2026; the traditional procurement systems of procurement emails, spreadsheets, and human approvals are falling behind. Organisations process hundreds or even thousands of purchase orders, supplier invoices, and payments every month. When these activities are manually performed, delays, errors, and missed possibilities become virtually assured. Procure-to-pay automation here starts its metamorphosis of company spending and payments from start to finish.

From submitting a purchase request and generating purchase orders to getting invoices and paying suppliers, the procurement-to-pay process covers the whole journey of buying goods or services. At every level, human participation was needed, therefore delaying the procedure and hence increasing its error-prone quality.

Intelligent software can manage these phases electronically thanks to procure-to-pay process automation, therefore speeding permissions, preserving data accuracy, and providing real-time traceability for every transaction.

Modern solutions now automate monotonous activities like invoice processing, three-way matching, and payment scheduling by combining OCR, AI-driven validation, and robotic process automation in procurement.

Automation tools take over mundane operations while people concentrate on strategy, vendor relationships, and financial planning instead of spending hours inputting data by finance departments. Organisations are cutting operating expenses and increasing compliance and openness thanks to this change.

As businesses grow and supply chains become more complex, procurement process automation is no longer just about convenience; it’s about staying competitive. Faster cycle times, enhanced cash flow management, and stronger supplier trust are among the benefits companies using rpa procurement systems are seeing.

This blog will look at what procure-to-pay automation really means, how it works, and why it is increasingly among the most efficient tools shaping current financial systems in 2026.

What is Procure-to-Pay Automation?

Procure-to-pay is the superhero form of the conventional purchasing process. This system monitors repeated tasks, speeds processes, and keeps everything correct and traceable instead of asking people to hunt for permissions, submit invoices, and reconcile spreadsheets by hand using technology.

Fundamentally quicker, more intelligent, and less prone to human error, procure-to-pay process automation streamlines the whole P2P cycle from purchase requests to supplier payments. Think of it as allowing finance and procurement teams to concentrate on strategy, relationships, and decision-making while robotics process automation in procurement and smart software undertake the major lift.

Automated systems offer transparency and control, unlike manual P2P, where lost invoices, delayed approvals, and mismatched data can create issues. Catch mistakes before they develop by modern solutions combining RPA procurement bots, real-time dashboards, and AI-driven validation. This is about establishing a flawless, clever flow of information that helps everyone from CFOs to suppliers, not only about saving time.

Key Points About Procure-to-Pay Automation:

- Among other repetitive tasks, it automatically manages permissions, payment planning, and invoice input.

- To expedite and ensure accuracy, RPA sourcing systems replicate human behaviour.

- Keeping information that is easy to check and saving it centrally helps keep the company ready for an audit and improves compliance.

- Gives current information about spending, supplier performance, and the allocation of the budget.

- Reduces the operating costs and the number of errors compared to the traditional manual P2P.

- It integrates financial and ERP systems for the efficient flow of the whole process.

- Helps analytical research in deciding strategies.

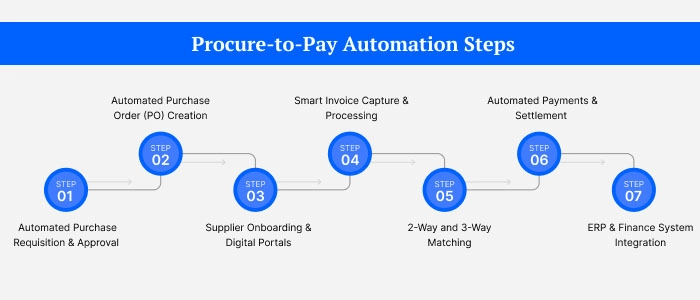

How Does Procure-to-Pay Automation Work Step by Step?

Consider your whole purchasing and payment process operating on autopilot but in a clever, regulated manner as procurement to pay automation. Automation joins every stage into one seamless digital flow instead of chasing approvals, manually inputting invoices, or wondering where a payment is held.

Using tools like robotics process automation in procurement, AI-powered invoice capture, and integrated finance systems, businesses can move from “we need to buy something” to “supplier paid” faster than ever, with full transparency and accuracy. This is the heart of modern procurement process automation, and it’s exactly why companies are switching to automated P2P in 2026.

Automated Purchase Requisition & Approval

Workers use a computerised system to submit purchase requests, which are immediately forwarded to the appropriate management for approval without the need for emails, paper, or delays.

Automated Purchase Order (PO) Creation

Once authorised, the system lowers human error in manual data entry by automatically generating a purchase order with all the necessary information and delivering it to the supplier.

Supplier Onboarding & Digital Portals

Via web gateways, suppliers properly submit their corporate, tax, and payment data, maintaining clean, compliant, and always current records.

Smart Invoice Capture & Processing

Automatically extracting data from invoices scanned or emailed into the system, OCR and artificial intelligence eliminate the need to type.

2-Way and 3-Way Matching

Catching overcharges or duplicates immediately, the software verifies correctness by matching the invoice to the purchase order and goods receipt before payment.

Automated Payments & Settlement

Once approved, payments are scheduled and released automatically via ACH, wire transfer, or digital payment methods, fast and traceable.

ERP & Finance System Integration

Real-time alignment of everything with accounting and ERP systems provides finance departments with total insight into cash flow, budgets, and open obligations.

What Are the Trending Technologies Powering P2P Automation in 2026?

Procure-to-pay automation in 2026 involves the use of smart technology that can think, learn, and act fast rather than just using less paper. Businesses are currently teaming up with automation, AI, and cloud systems to change their slow procurement processes into smooth digital experiences.

Nowadays, procurement process automation is done through smart tools that spot errors, automatically route activities, and give instant insights with just a few clicks instead of finance departments physically checking invoices or chasing approvals. It is the technology, driven transformation that distinguishes procure-to-pay automation as one of the most significant advancements in today’s financial operations.

Automation of robotic procedures

Working 24/7 with zero fatigue or faults, RPA procurement bots manage monotonous activities, including invoice uploads, PO development, data entry, and approvals.

OCR and intelligent paper processing

These technologies swiftly gather crucial data from bills, invoices, and contracts before transforming it into practical digital records.

AI-Driven Exception Management

Before they result in expensive problems, intelligent systems highlight unusual spending patterns, recurring payments, or inaccurate invoices.

Real-time analytics and dashboards

Finance directors quickly note spending, approvals, supplier performance, and cash flow. No monthly reports waiting.

Mobile access and cloud platforms

Procure-to-pay process automation is fast and adaptable since teams can authorise purchases, monitor invoices, and issue payments anywhere.

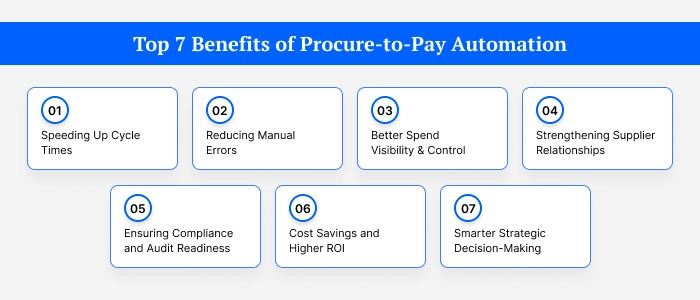

Top 7 Benefits of Procure-to-Pay Automation

Years ago, manual acquisition could have been effective; however, in 2026, it just cannot match the pace companies need. Time, money, and energy are taken from continual approval emails, mislaid invoices, and delayed payments. Organisations are thus adopting procure-to-pay automation to produce quicker processes, cleaner data, and improved financial control.

Powered by tools like rpa procurement, intelligent document processing, and real-time analytics, procurement process automation is turning the P2P cycle into a seamless digital experience. Here’s how it makes a real difference:

1. Speeding Up Cycle Times

At every stage of the procurement process, automation eliminates delays. For approvals, purchase requests are instantaneous; POs are produced automatically; invoices are handled as soon as they arrive. Keeping activities going smoothly and suppliers pleased, this significantly decreases the time between placing an order and paying.

2. Reducing Manual Errors

Human data entry often leads to mistakes such as duplicate payments, incorrect amounts, or missing approvals. With robotics process automation in procurement, repetitive tasks are handled by software that follows set rules every time. This improves accuracy, prevents costly errors, and ensures consistent processing.

3. Better Spend Visibility & Control

One dashboard pulls together all procurement and payment information via automated systems. Financial teams may check budgets, monitor real-time expenditures, and immediately recognize weird expenditures. This sort of openness lets companies make wise choices and so prevent overpaying.

4. Strengthening Supplier Relationships

Late payments and poor communication often stress vendor relationships. Automation of the acquire-to-pay procedure guarantees faster approvals, consistent payments, and less conflict. Long-term cooperation and trust are enhanced when vendors are paid on time and fairly.

5. Ensuring Compliance and Audit Readiness

Approvals to payments at every stage in the automated P2P process are logged electronically. This offers a strong audit trail that helps internal controls and legal compliance. Audits get less stressful, faster, and simpler.

6. Cost Savings and Higher ROI

Companies can drastically reduce operational expenses by eliminating human effort, minimising errors, avoiding late penalties, and taking advantage of early payment savings. Over time, the ROI of procurement process automation becomes evident and measurable.

7. Smarter Strategic Decision-Making

Every step in the automated P2P process is electronically recorded, from approvals to payments. This offers a strong audit trail that helps internal controls and legal compliance. Procurement data becomes insightful under automation that helps companies grow over time.

What are the Best Practices for Implementing P2P Automation?

Rolling out procure to pay automation involves developing a more intelligent, simpler process that really benefits your staff and your company, rather than buying a new program and hoping for the best.

Automated procure-to-pay procedure eliminates delays, lowers errors, and provides complete spending visibility when done correctly. But when hurried or ill-conceived, it could cause misunderstanding rather than productivity.

Following a few established best practices can enable companies to release procurement process automation’s whole potential while still keeping teams involved and motivated.

- Define Requirements in Simple Language: Stakeholders, & First identify the unpleasant areas, then design your current P2P procedure. Include departments early on: leadership, finance, IT, and procurement, so everyone knows their goals, roles, and success criteria.

- Choose the appropriate platform: Start from requisitions up to payment and try to find answers that can help automate from one end to the other. Sand has characteristics including robust security, invoice capture, analytical capabilities, and RPA procurement bots.

- Standardise Approval Workflows: Determine the uniform guidelines for approval of purchases according to the limit of money, departments, and risk levels. This simply eliminates misunderstanding, hastens decision-making, and automatically enforces the policies.

- Integrate ERP, Finance, and Procurement Tools: Perfect internal interfacing of different systems allows not only for real-time data exchange between accounting, inventory, and procurement platforms but also for stopping the extra double work and making the data more accurate.

- Track KPIs That Actually Matter: Keep an eye on the metrics like the time it takes for an invoice to be processed, the cost of a transaction, the speed of the approval cycle, the rate of errors, and the punctuality of payments to be able to measure the performance and hence the ROI.

- Continuously Improve With Analytics: Make the most of the analytics tools to identify the causes for delays, the irregularities in spending, and the issues with suppliers; after that, smooth the workflows for higher efficiency.

What Future Trends Are Driving Procure-to-Pay Automation in 2026?

Procure-to-pay automation will have advanced past simple task automation by 2026 to produce more intelligent, fully integrated systems that help businesses to work more strategically and safely.

Procurement process automation currently manages all from supplier risk to approvals in one, fluent flow by the integration of cloud-based technologies, artificial intelligence-powered analysis, and RPA procurement.

Instead of merely automating jobs, the companies are building smart ecosystems that, among other things, help in compliance, decision-making, and long-term growth through the procurement-to-pay process automation.

Key Trends Powering P2P Automation in 2026:

- End-to-end workflow orchestration is the process of connecting every stage of procurement and payment into one automated, smooth process.

- Tracking ethical sourcing, green suppliers, and environmental effects straight inside P2P systems will help with sustainability and ESG integration.

- Hyper automation Across Finance: Blending robotics process automation in procurement with AI and analytics throughout finance operations

- Early identification of supplier problems, fraud risks, and legal concerns using real-time data helps with supplier risk and compliance monitoring.

How Do Companies Use Procure-to-Pay Automation in Real Life?

For present finance and procurement teams in the actual world, procuring to pay automation is becoming necessary, not merely a good-to-have. Accelerating invoice processing, streamlining approvals, and eliminating human labor allow companies to save time, lower costs, and remain compliant with minimum effort. Using robotics process automation in procurement, businesses get more fluid workflows and improved spending visibility by handling routine tasks like order matching and data input.

Procurement process automation assists teams concentrate less on paperwork and more on wise decision-making from startups to worldwide corporations; once they do, there’s no way back. Procurement process automation assists teams concentrate less on paperwork and more on wise decision-making from startups to worldwide corporations; once they do, there’s no way back.

- Medium-sized companies implement procure-to-pay automation to make the process of invoice approval quicker, keeping a tighter check on the budget, reducing the chances of mistakes, and handling the vendor department without greatly increasing the number of finance team hires.

- Large multinationals count on RPA procurement to efficiently perform up to thousands of transactions each day, maintain compliance in different countries, automate tax-related processes, and ensure the supplier payment cycle works without any disruptions.

- Retail and eCommerce brands automate the whole process of purchase orders, invoicing linked to inventory, and payments to suppliers, so as not to run out of stock and be able to manage cash flows quite well.

- Manufacturing industry players employ robotics process automation in their procurement function to automatically match purchase orders with invoices, monitor the expenditure on raw materials, and save the business from making expensive payment errors.

- Tech and SaaS companies set automation in motion for vendor onboarding, contract signing, and making periodic subscription payments so that they would be able to grow quickly without running into budgetary problems, mostly caused by the finance department.

- Healthcare and pharmaceutical companies automate procure, to, pay processes to be able to process large volumes of highly regulated supplier invoices with accuracy while also staying compliant.

What Are the Best P2P Automation Tools to Compare in 2026?

| Comparison Area | What It Means in Real Life | Why It Matters in 2026 |

|---|---|---|

| Core P2P Features | Covers purchase requests, approvals, supplier onboarding, invoice capture, three-way matching, and automated payments in one flow | Full procure-to-pay automation removes manual gaps, speeds up processing, and avoids costly errors |

| AI & RPA Capabilities | Uses AI to read invoices and robotics process automation in procurement to handle repetitive tasks like data entry and matching | Saves massive time, improves accuracy, and lets teams focus on strategy instead of paperwork |

| ERP & Tool Integration | Connects smoothly with finance systems like ERP, accounting software, and supplier portals | Keeps data in sync and gives real-time visibility across the procurement process |

| SaaS (Cloud) Platforms | Web-based systems that update automatically and work from anywhere | Faster setup, lower IT costs, better scalability, and remote-friendly workflows |

| On-Premise Solutions | Installed on company servers with more control but higher maintenance | Still useful for highly regulated industries, but less flexible for fast growth |

| Cost vs Value | Looks beyond price to automation depth, AI features, and efficiency gains | Strong procurement process automation delivers long-term ROI even if the upfront cost is higher |

| Ease of Use | Clean dashboards, mobile approvals, and simple workflows | Higher user adoption = smoother operations and faster results |

| Support & Training | Vendor onboarding, troubleshooting help, and learning resources | Ensures smooth implementation and long-term success |

Facing endless invoice approval bottlenecks?

Automate procure-to-pay effortlessly today

Conclusion

Procure-to-pay automation is increasingly the foundation of smart, modern companies as we enter 2026, not only a financial improvement. Companies are finally switching from slow approvals, disorganised spreadsheets, and manual invoice processing to linked digital workflows that travel flawlessly from purchase request to ultimate payment.

Real-time visibility into spending, fewer errors, and shorter cycle times for procurement teams come from procure-to-pay process automation driven by cloud platforms, artificial intelligence, and RPA. Running procurement in a more intelligent, more regulated, and stress-free manner is what matters rather than just speed.

The way procurement process automation releases people from monotonous chores and converts data into improved decisions is really what sets it apart. While finance teams concentrate on strategy, supplier relationships, and expansion, robotics process automation in sourcing manages everyday chores behind the scenes.

P2P automation is no longer a “nice-to-have” in a world where companies must move quickly and stay compliant; it separates staying up from falling behind. Smart automation is just how effective businesses work in 2026.

FAQ’s:

1. What is procure-to-pay automation in simple terms?

Procure-to-pay automation is the use of digital tools, AI, and RPA to manage the full purchasing cycle from raising purchase requests to paying suppliers without manual paperwork or delays.

2. How does procure-to-pay process automation help businesses save money?

It reduces human errors, speeds up invoice processing, prevents duplicate payments, and gives real-time spend visibility, helping companies control costs and negotiate better with suppliers.

3. Is P2P automation only for large enterprises?

Not at all. Mid-sized businesses and fast-growing startups use procurement process automation to scale faster, stay compliant, and manage suppliers efficiently without hiring huge finance teams.

4. What role does RPA play in procurement automation?

RPA procurement uses software bots to handle repetitive tasks like invoice matching, data entry, approvals, and vendor onboarding, making processes faster, cleaner, and more accurate.

5. Is procure-to-pay automation secure and compliant?

Yes. Modern P2P platforms come with built-in controls, audit trails, approval rules, and fraud detection features that improve security while keeping companies compliant with financial regulations.

+1 646 500 3924

+1 646 500 3924 +91-20-29701664

+91-20-29701664